INGIUM EQUITY

We give capital markets back to the companies.

1 500 885 KES (120%) of 1 000 110 - 5 000 088 KES goal funded

KES 20,000 min investment

INVESTBRIEF INTRODUCTION

Ignium is inviting you to be a part of it’s journey creating digital capital markets for small and medium sized companies.

We are here to democratise the system and shape a new brighter future for capital raising companies and investors alike. Become a shareholder with as little as KES 20,000. Owning digital shares in Ignium gives you all the rights of a traditional shareholder without all the paperwork.

Small and medium sized companies and their investors have been treated as second class citizens for too long. Join us, foster change, and be part of the spark that ignites new ideas, fixes old problems, and generates wealth globally.

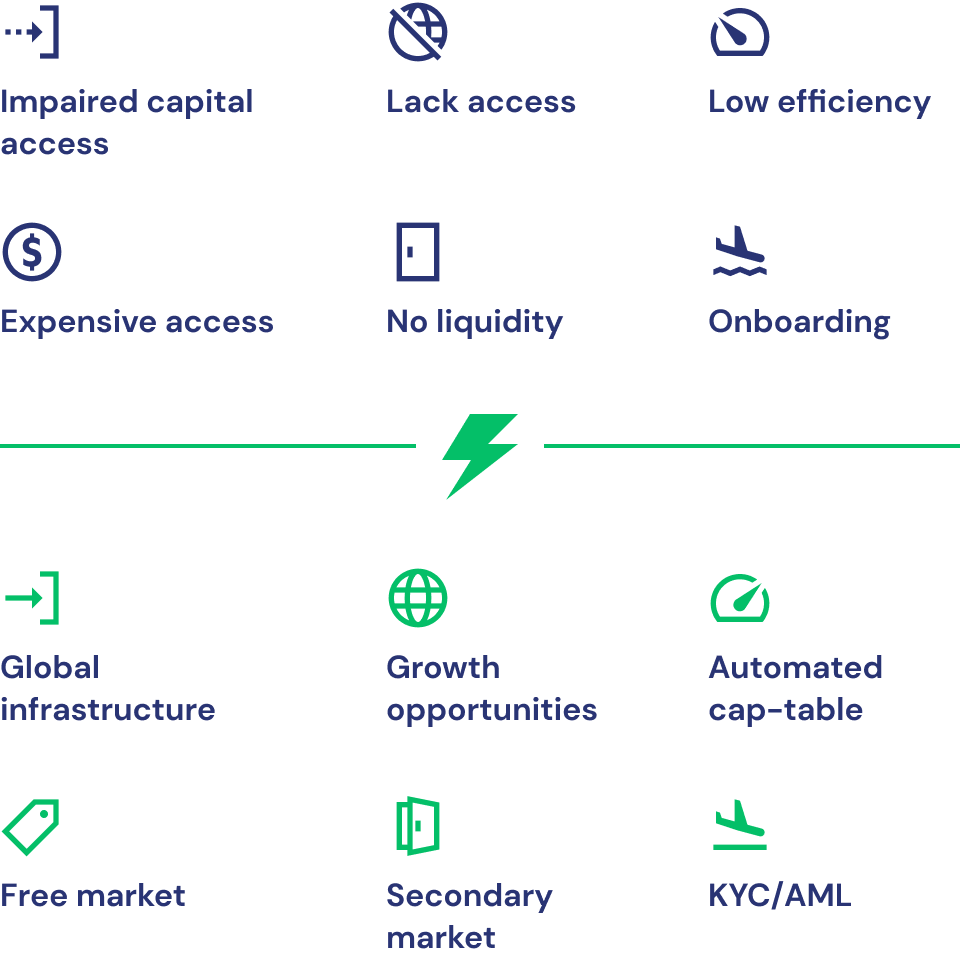

PROBLEM AND SOLUTION

SME’s lack access to capital and capital markets are prohibitively expensive. Retail investors do not have access to private company securities and returns.

Private company investors and employees lack liquidity of their shares causing negative price pressure and limiting exit possibilities.

Small and medium sized companies (especially those in a cross-border business) have constant uphill battle for making their presence in competation with large corporations for the same markets with often 10s or 100s times smaller budgets.

Onboarding of foreign investors is often close to impossible.

Maintaining investor's register and employee option program is time consuming and inefficient.

Igniums’ e-Commerce type of market for private company securities connects investors and companies globally, facilitates creating investomers and enhancing sales by enabling SME’s to share investors and customers. We share 25% of trading commissions with the issuing companies.

On the top of that Ignium offers state-of-the-art captable solution.

Our solution is with no frontloaded costs and truly affordable - exactly as SMEs need it.

PRODUCT / SERVICE DESCRIPTION

Ignium has three great products that are all combined into one seemless offering.

First, we enable issuing digital securities to investors across the world and keep real-time updated investor register.

Second, we operate peer-to-peer market where investors can interact and trade with one-another.

Third, we offer companies cap-table solution.

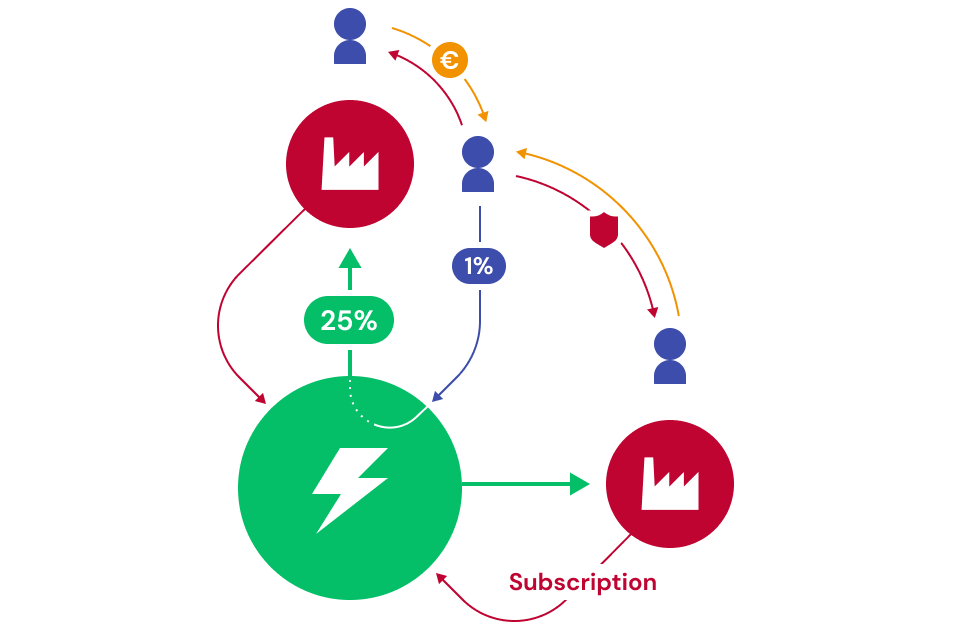

BUSINESS MODEL

Unlike its competitors who frontload costs onto their clients Ignium approaches its pricing model from a different angle. The company’s ethos of doing what is right with a focus on accessibility in capital markets is clearly echoed in the way it prices its services.

Say goodbye to fixed fees for issuing a security, at Ignium, regardless of the size of your company you pay just KES 10,000 a month for as long as you are an active client.

Listing fees to get your asset onto our secondary market? KES 0

Commission (sell-side only) on the secondary market? 1% (based on the transaction value, capped at KES 30,000)

Cap-table and ESOP service fees for issued and listed assets? KES 0

MARKET

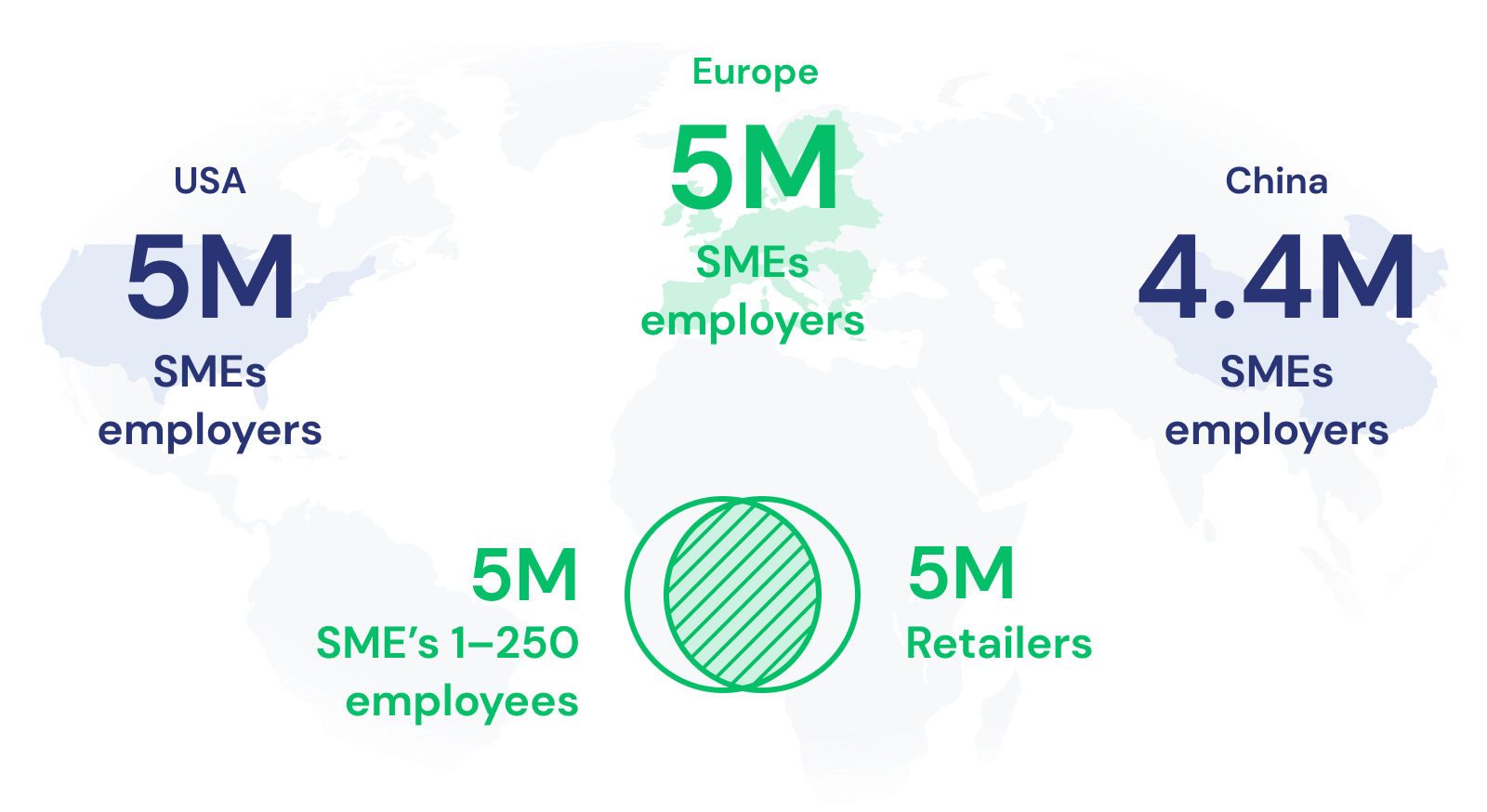

A secondary market for private company liquidity does not exist today in a scalable manner. To put it simply this means that the pain of not having access to functional capital markets is real, it is well known, and the addressable market is massive.

65 million incorporated SMEs in the world are with unmet financing need and hundreds of millions of active retail investors in other asset classes who also long to invest in private companies. We can connect them and create a new untapped market for private company securities.

ACHIEVEMENTS SO FAR

The Company has grown from an idea shared around a conference table to a fully functional enterprise level system in slightly less than two years. Initially bootstrapped by the co-founders ignium raised its first round

in early 2020 securing 1.2M EUR from private angel investors in the USA. This money allowed the company to scale its team and build additional services and products onto its offering, gearing up for the next steps ahead in its evolution…. Traction and growth.

Ignium operates as a non-regulated platform that does not require any financial services licenses. This lean operational model fits very well with the current early stage of the company and enables it to move fast and to be agile.

In August 2020 Ignium onboarded its first client and by May of 2021 that number had expanded to 15 onboarded issuers and over 3,000 onboarded investors. In the first quarter of 2021 Ignium’s secondary market went live, supporting an initial volume of 150 trades valued at over 50,000 Euros.

As Ignium prepares for its next steps forward the company is screening regulatory requirements in several different countries including Latvia, Finland, Sweden and the UK.

HOW WE STAND OUT

Ignium is capital market like no other. It is e-commerce of small and medium company securities.

We connect capital market with day-to-day business of the issuer companies.

Second, we operate peer-to-peer market where investors can interact and trade with one-another.

Ignium’s goal is to give back the capital markets to the participants, to the companies and individuals who issue, trade,

and transact, and to do that it had to make sure that its own goals were aligned with that of its clients. There is no better way to reach this goal than through Ignium’s own Stronger Together program, where the company shares 25% of the revenue generated from its secondary market with the issuer (SME). This type of aligned approach is a first of its kind in capital markets and Ignium strongly believes this will enable small and medium sized companies to unlock their potential and change the way they interact with potential customers and investors, enabling these companies to build a solid following of investomers.

USE OF MONEY AND SCHEDULE

Growth and expansion is the prime focus. What does that mean for Ignium?

Expansion - feasibility studies around possible new markets and the teams responsible for expansion.

Development - building additional product teams to support the company's growing list of sub-products (cap-table, the SME marketplace, employee options management, etc)

Marketing - allocating an appropriate budget and hiring a world class team focused on product marketing.

Sales - build in-house sales to focus on client acquisition (SMEs) as well as management of our distribution network.

Support - 24/7 client facing support is vital to ensure we stay a cut above the competition. Building a knowledgeable team is of high priority.

PROMISES TO THE INVESTOR, PROFIT DISTRIBUTION

Investors become holders of equity shares with all the associated rights.

As early stage company in huge market our primary task is to grow . We do not forsee being in position of distributing dividends in coming years.

Shares will be tradable on Ignium peer-to-peer market.

RISKS AND HEDGING

Risk of change of company's plans, markets and products

The success of startups in the technology industry will likely be dependent on the strength of the overall technology industry, which is characterized by rapidly changing technology, evolving industry standards, new service and product introductions and changing customer demands. The changes and developments taking place in this industry may require the company in which investors invest to reevaluate its business models and adopt significant changes to their long-term strategies and business plan. The failure of the company to make such changes would materially adversely affect the business of the company, and potentially have a material negative impact on the returns of investor’s investment in the company, including potentially a complete loss of investment.

Company has limited operational history

The company is still in an early phase, and is just beginning to implement its business plan. There can be no assurance that it will ever operate profitably. The likelihood of its success should be considered in light of the problems, expenses, difficulties, complications and delays usually encountered by companies in their early stages of development, with low barriers to entry. The Company may not be successful in attaining the objectives necessary for it to overcome these risks and uncertainties.

Additional funding that the company may need could not be available

The company may require funds in excess of its existing cash resources to fund operating deficits, develop new products or services, obtain activity licence, establish and expand its marketing capabilities, and finance general and administrative activities. Due to market conditions at the time the company may need additional funding, or due to its financial condition at that time, it is possible that the company will be unable to obtain additional funding as and when it needs it. If the company is unable to obtain additional funding. If the company is able to obtain capital it may be on unfavorable terms or terms which excessively dilute then-existing equity holders. If the company is unable to obtain additional funding as and when needed, it could be forced to delay its development, marketing and expansion efforts and, if it continues to experience losses, potentially cease operations.

Company's growth relies on broad market acceptance that may not occur

While the company believes that there will be significant customer demand for its products/services, there is no assurance that there will be broad market acceptance of the company's offerings. There also may not be broad market acceptance of the company's offerings if its competitors offer products/services which are preferred by prospective customers. In such an event, there may be a material adverse effect on the company's results of operations and financial condition, and the company may not be able to achieve its goals.

Company may not be able to acquire required activity licence(s) or this may take longer than anticipated

The company may need to obtain an activity licence to conduct its activities on a broader scale. Obtaining such a licence may be costly and require extensive time having a negative impact on the ability of the company to conduct its business or such licence may be denied for the company which may have negative effect on the business of the company.

Company name: Ignium LTD

Company registry code: 14767998

Company address: Westlands, Nairobi, Kenya

Company phone number: +254711122333

Company e-mail address: info@ignium.co.ke

Funder e-mail address: care@funder.co.ke

Investment size: 7,011,000 - 10,008,800 KES

Offered participation: 5%

Offered participation per investor: KES 20,700 to KES 1,660,000

Current share capital: 1,132,500 KES

Present value of the company: 200,000,000

TEAM

Reimo Hammerberg

CEO

20 years as a capital markets and financial services partner and head of practice in a leading law firm. Experienced board member.

Kevin Murcko

Co-founder

Kevin is a thought leader in FX, Crypto, Blockchain and Financial Regulation focusing on removing barriers and bringing real substantive change to capital markets globally. As the founder of CoinMetro, a co-founder of Ignium, and a founding board member of the European Crypto Association he is now looking to help shape a tokenised future. Kevin Murcko is a known face in the retail FX world, his company FXPIG was a pioneer in bringing transparency to retail FX, garnering him the unofficial title of one of the most transparent CEOs in the financial industry.

Normunds Blumbergs

CTO

Normunds has over 16 years of experience in large enterprise software development as a software architect/project manager. During the last 7 years he has co-founded multiple SaaS startups, and was involved in all areas of their creation. He has led multiple large software project development teams in developing complex enterprise systems or SaaS solutions (including FinTech), often also taking responsibilities of designing the overall system architecture. He’s also experienced in lean and agile practices, as well as the application of those practices in startup environments.